Payroll

Standard, Professional, Enterprise & Cloud Editions

Click the link below to view the file. Download Acrobat® Reader

Payroll Brochure.pdf

The BIS®Payroll module makes it easy to perform the tedious job of calculating, tracking and reporting for local, state and federal government required payroll reports. Quarterly Reports, Certified Payroll, Prevailing Wage, Minority Utilization, Worker's Compensation and Union are a snap with BIS®. (Union module available in BIS® Professional and Enterprise)

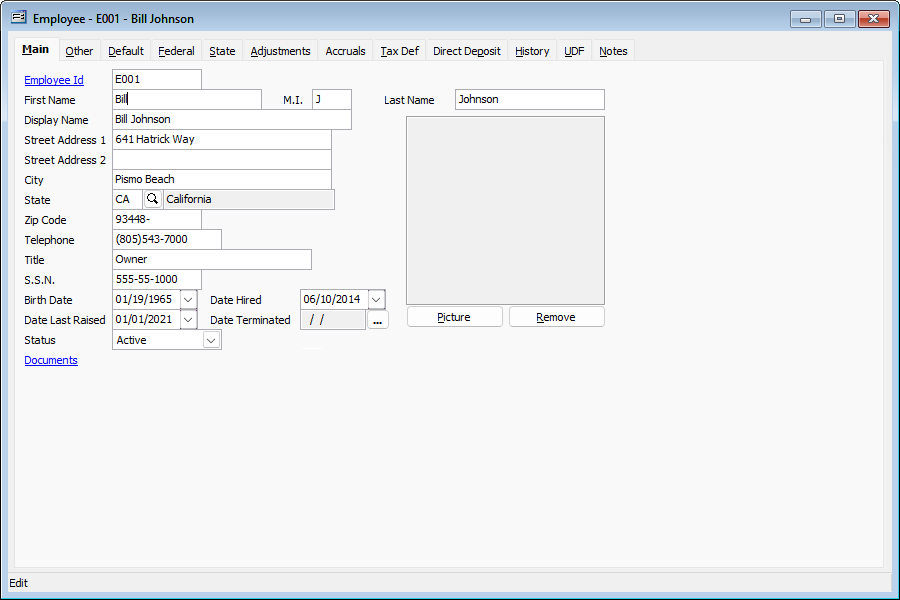

Payroll Sample Screen

Click the screenshot for a larger image.

Payroll Features

- Entries automatically update the Payroll Journal, Employee File, Employee History, General Ledger, Job Cost File and Financial Statements

- Automatically computes payroll taxes for all fifty states, the District of Columbia and Puerto Rico

- Automatic company-wide and employee specific user defined earnings, deductions, tax deferred and local taxes

- User-definable over-time and double time rates through trade classifications

- Prepares Federal 940 and 941 Worksheets

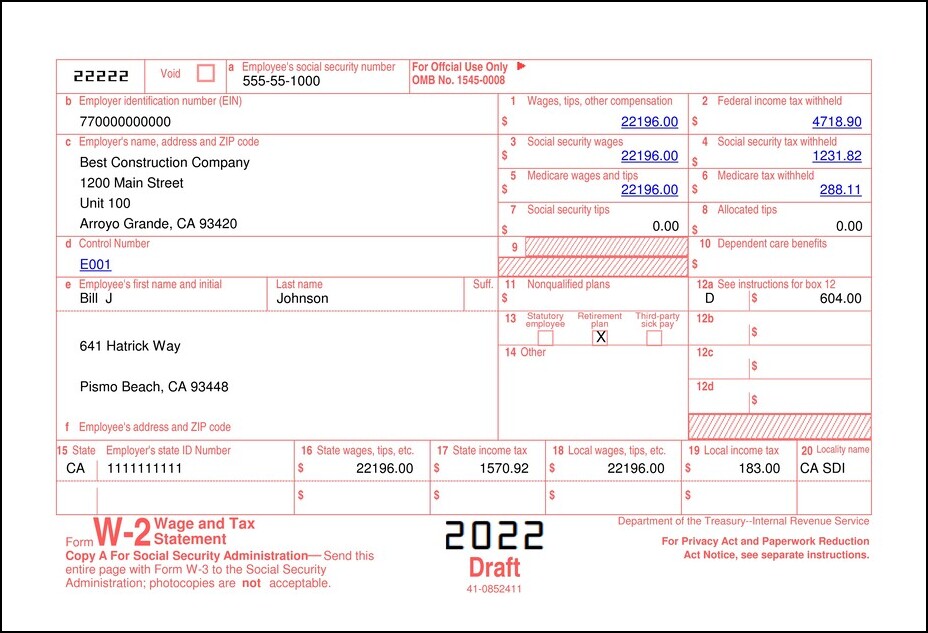

- Prepares W-2 Forms

- Prepares a prepayment edit list of payroll checks for cash demands and final verification prior to printing checks

- Payroll hours can be distributed to multiple jobs, cost codes, change orders, worker's classifications and unions (Union module available in BIS® Professional and Enterprise)

- Employee user numbers are user definable, and include up to ten alphanumeric characters, also provides a twenty five character employee last name description field

- Multi State payroll (BIS® Professional and Enterprise)

- Recurring Payroll (BIS® Professional and Enterprise)

- Crew Hours (BIS Professional and Enterprise)

- Timecard Import from Third Party (BIS Professional and Enterprise)

- Payroll Checks (After the Fact Payroll)

- Direct Deposit (BIS® Professional and Enterprise)

- User Definable Fields (BIS® Professional and Enterprise)

Payroll Reports

- Employee List Summary, Detail, Extended, Automatic Adjustments or Udf

- Employee Ledger Summary or Detail

- Employee Labels - 10 pre-defined Avery® continuous or laser labels

- Crew List

- Labor Rate Classifications

- Payroll Additions Summary or Detail

- Payroll Deductions Summary or Detail

- Payroll Tax Deferred Summary or Detail

- Payroll Local Taxes Summary or Detail

- Prepayment List Summary, Detail, Job Distribution and Totals

- Time Card Report

- Payroll Journal Summary, Detail or Extended

- Recurring Payroll Groups Summary or Detail

- Recurring List Summary, Detail, Job Distribution and Totals

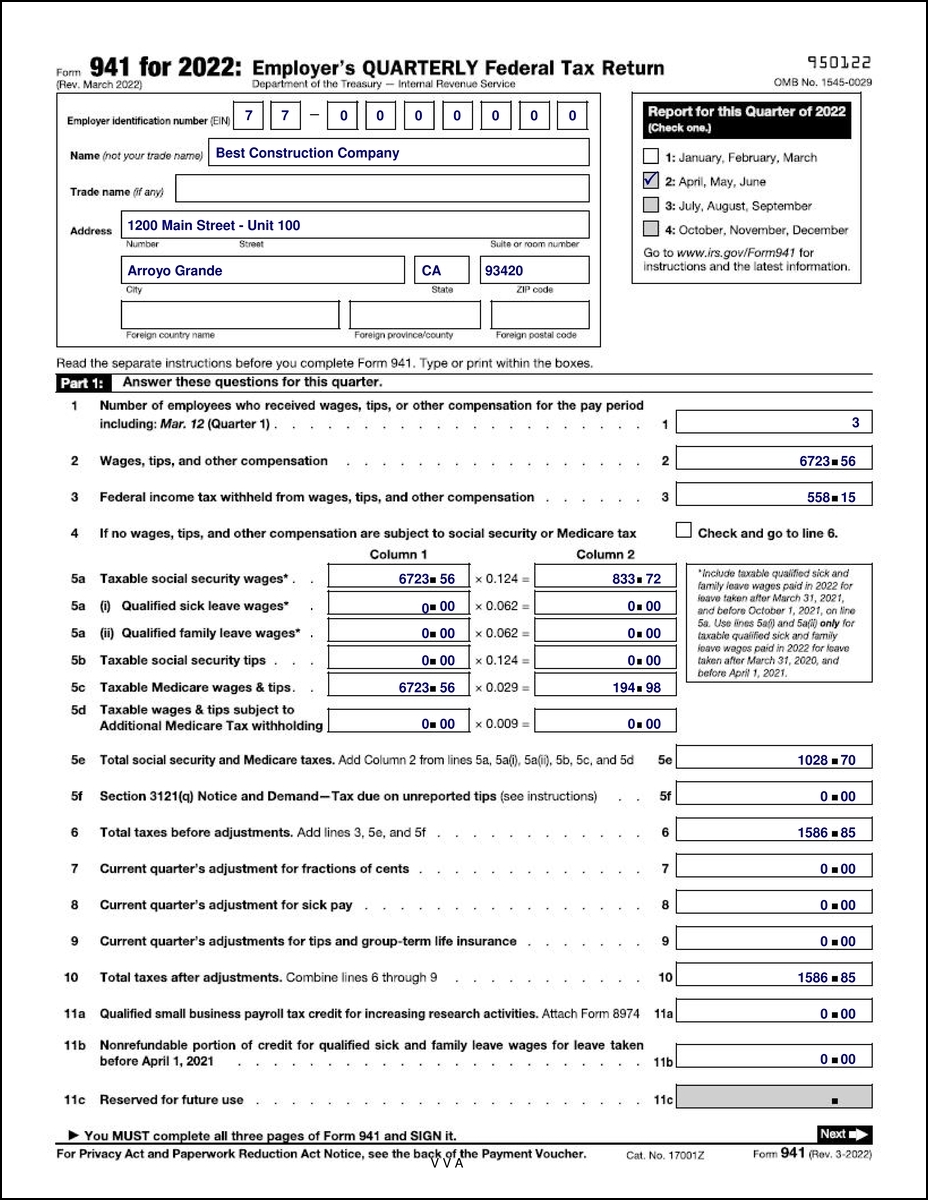

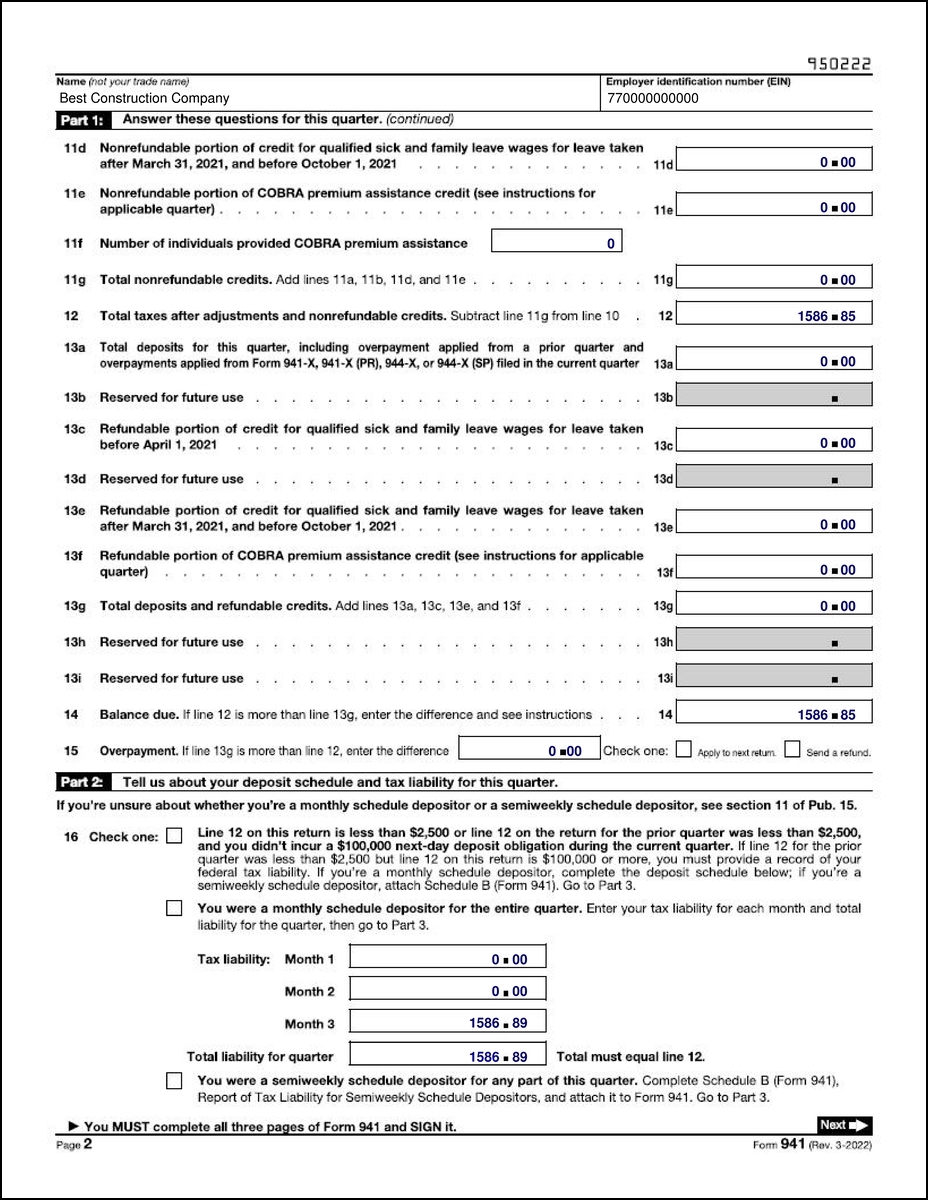

- 941 Quarterly Federal Tax Return Worksheet (IRS Approved Code VVA) or Schedule B

- 940 Annual Federal Unemployment Worksheet

- Federal Unemployment Summary or Detail

- State Unemployment Summary or Detail

- Quarterly State Wages Summary or Detail

- State Disability Insurance Summary or Detail

- Gross Wages Summary or Detail

- Taxable Wages Summary, Detail or Extended

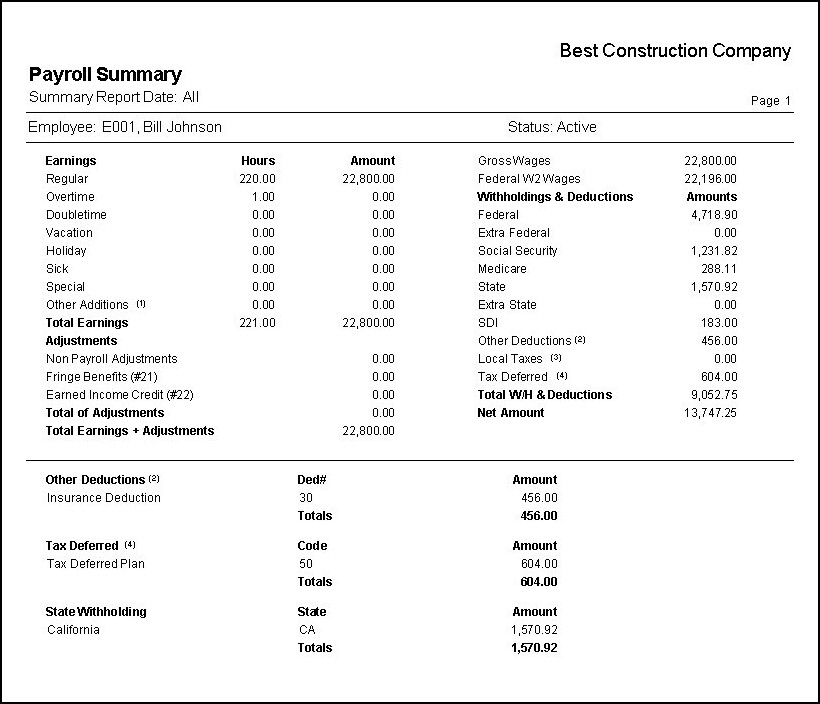

- Payroll Summary

- Monthly Employment Utilization by Trade or Employee

- Tax Deferred Summary or Detail

- Worker’s Compensation Classifications Summary or Detail

- Worker’s Compensation Transactions Summary by Classification

- Worker’s Compensation Transactions Summary by Classification/Employee

- Worker’s Compensation Transactions Summary by Employee/Classification

- Worker’s Compensation Transactions Detail

- Worker’s Compensation Report Summary by Classification

- Worker’s Compensation Report Summary by Classification/Employee

- Worker’s Compensation Report Summary by Employee/Classification

- Worker’s Compensation Report Detail

- Certified Payroll Trade Classications Summary

- Certified Payroll Pay Periods Summary or Detail

- Certified Payroll Detail

- California DE-6 Submittable Quarterly Wage (BIS® Professional and Enterprise)

- W2 Laser, Laser-Draft or Continuous (BIS® Professional and Enterprise)

- W3 Transmittal Laser, Laser-Draft

- W2 Electronic Filing – Social Security Administration and selected States (BIS® Professional and Enterprise)

- Tax Deferred Plans

- Cafeteria Plans

- Labor distribution report

- Payroll Journal

- Reprint Check Run Report

- Department of Labor and Industry (WA State) Reports

- Adjustments Ledger – Additions Summary, Detail or Extended Reports

- Adjustments Ledger – Deductions Summary, Detail or Extended Reports

- Adjustments Ledger – Tax Deferred Summary, Detail or Extended Reports

- Adjustments Ledger – Local Taxes Summary, Detail or Extended Reports

- Adjustments Ledger – By Employee Summary, Detail or Extended Reports

- Vacation Ledger

- Sick Pay Ledger

- And more...

Payroll Sample Reports

Hyperlinks fields as shown on the following sample report preview screens can be disabled when printing, exporting or emailing reports.

Click the screenshot for a larger image.

Click the screenshot for a larger image.

Click the screenshot for a larger image.

Click the screenshot for a larger image.