Bank Reconciliation

Standard, Professional, Enterprise & Cloud Editions

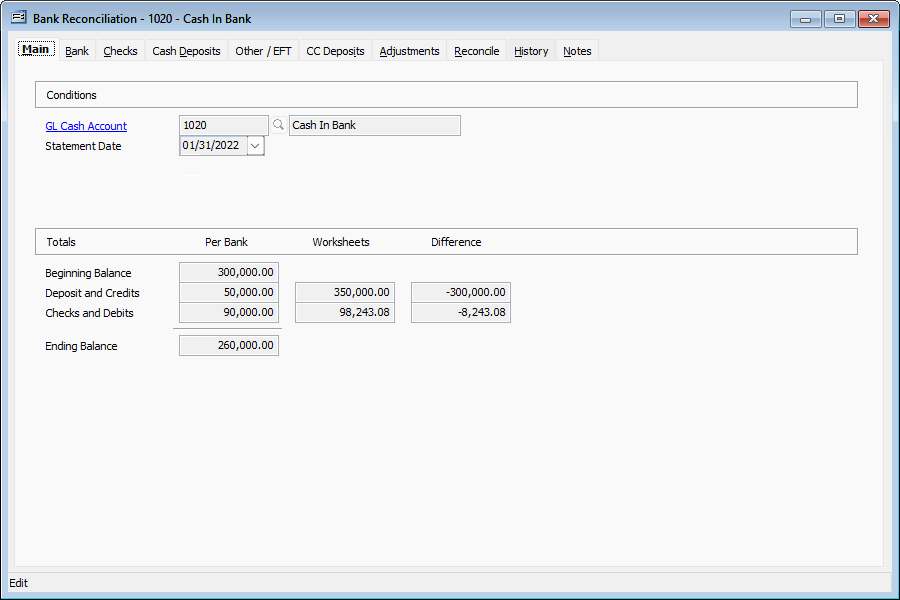

The BIS® Bank Reconciliation module helps users quickly and efficiently balance any bank account. If an account doesn't immediately balance, Bank Reconciliation helps users isolate the problem in cash deposits, cash disbursements, credit card deposits, Other/Electronic Fund transfers or is a result of an unrecorded cash transaction.

Bank Reconciliation Sample Screen

Bank Reconciliation Features

- Bank deposit listings can be prepared from items entered in the Cash Receipts

option of the General Ledger or Accounts Receivable invoicing

- Omitted transactions including payments, receipts, Electronic Fund Transfers (EFT) and cash-related journal entries can be created from within the reconciliation process

- Save in-progress bank reconciliations

- Access prior reconciliations with the Reconciliation History

- Optionally delete prior reconciliations (with audit trail)

- Easily track cash transfers between bank accounts

- Easily track Electronic Fund Transfers (EFT) receipts

- Deposit slips can be for a single date or range of dates

- Deposit slips can be processed for different payment types

- Deposit slips can be processed for credit card transactions

- Move receipts between cash and checks

- Place individual receipts on hold for an unspecified period of time

- The Bank Reconciliation Module is used to reconcile the balance on bank statements to the General Ledger cash accounts

- Reconcile multiple cash accounts at the same time (BIS® Professional and Enterprise)

option of the General Ledger or Accounts Receivable invoicing